Summary

- This study offers two new forensic portfolios for 2025, using top algorithms to detect bankruptcy risk, earnings manipulation, and financial irregularities.

- Negative forensic stocks have shown higher returns and volatility, with a 10x higher merging or delisting rate compared to positive forensic stocks.

- Positive forensic stocks provide stable returns, outperforming the S&P 500, and are less likely to face financial distress or manipulation.

- The last 12 portfolios have delivered average returns: Negative Forensic +46.33% and Positive Forensic +32.77% compared to the S&P 500 Index average: +11.69% in the same period.

- Stocks can be extremely different across portfolios and it is important to read the first 2 steps in the Getting Started Instructions to build yourself an optimal portfolio mix for your own personal risk tolerance.

Introduction

This is a fundamental value study that offers two new forensic portfolios for 2025 to continue testing the top four forensic algorithms applied to detect bankruptcy risk, earnings manipulation, and financial irregularities. This forward testing study makes portfolio selections from the highest positive and highest negative scoring stocks across the U.S. stock exchanges to measure performance variances between portfolios and benchmark indexes.

Over the past 8 years from 2017 on Seeking Alpha, I have published 50 different portfolios in one-year test periods. As a result of this long term analysis we are seeing strong differentiation in results between negative and positive forensic portfolios. Most notably, the delisting of stock symbols (merger, acquisition, leaving the exchange) are approximately 10x higher among negative forensic stock selections than for positive forensic stocks. We see that average price behavior for positive forensic stocks is more stable, but that greater individual returns are coming from the negative portfolios. Overall the negative forensic stocks are producing much higher returns, with larger variability and at a much higher rate of mergers/delisting.

Forensic Value Portfolios

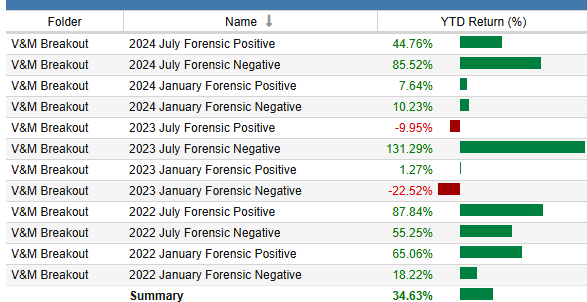

These are the most recent Forensic portfolios over the past 3 years released every 6 months. All the 2024 portfolios are positive not adjusted for dividends with extremely strong gains in the most recent July portfolios. Over the past 4 years including the current July 2024 portfolios with partial 6 months returns:

- Negative Forensic average: +46.33%

- Positive Forensic average: +32.77%

- S&P 500 Index average: +11.69%