Summary

- The Top Dividend Growth stock model combines high dividends and reliable growth variables for optimal long-term returns, despite lower frequency of price breakouts.

- Current weekly market conditions are negative, with the S&P 500 showing weakness through two consecutive negative weekly signals.

- Market conditions favor Growth stocks over Value stocks, with S&P 500 skewed by high P/E Mega Tech stocks; consider macro factors when investing.

- January 2024 Growth & Dividend portfolio is up 21.2% YTD with peak gains of +31.2% in November and declines into December along with the broader market.

- The average returns of the 15 most recent Growth & Dividend portfolios is 15.92% with compounded annual returns of 117.2% from 2020 not including large dividend distributions.

Introduction

The Top Dividend Growth stock model expands on my doctoral research analysis on multiple discriminant analysis (MDA) adding new complexities with these top dividend picks. Research shows that the highest frequency of large price breakout moves are found among small cap stocks with low trading volumes that offer no dividends and deliver higher than average risk levels.

Top Growth & Dividend Long-Term Stocks For January 2025

The challenge with the Top Dividend & Growth model is to deliver a combination toward optimal total return with characteristics of high dividends that typically reduce the frequency and magnitude of price breakouts, but deliver more reliable growth factors for higher profitability longer term.

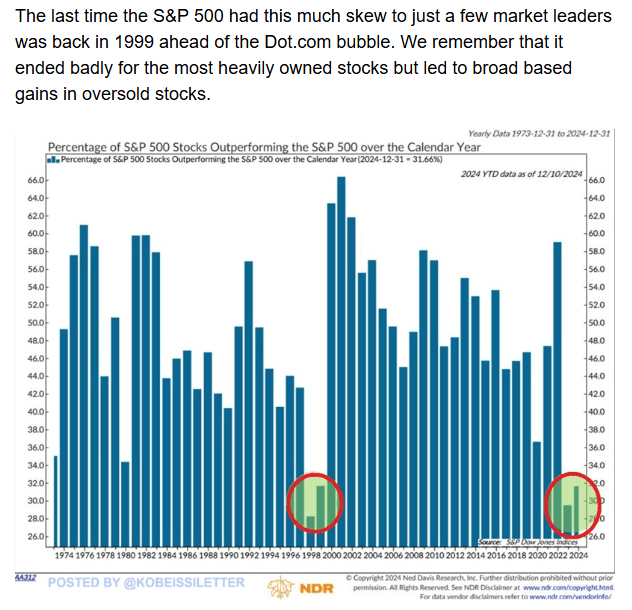

Related to this record divergence between Growth & Value stocks is the record market skew with the fewest % of S&P 500 stocks outperforming the S&P 500 index over the past year since 1998. Much of this crowding is into the 10 largest Mega Tech stocks that have an average Price/Earnings ratio of 57.5 compared to the broad P/E ratio of the S&P 500 at 21.6 (including the largest Mega Tech stocks).