Summary

- The January 2025 Piotroski-Graham portfolio includes top value stocks screened for high Piotroski F-Scores and Graham enhancements, aiming for strong long-term gains.

- Historical performance shows these value portfolios have consistently outperformed the S&P 500 over the long term 2-year measurement with the January 2023 portfolio up +139.7%.

- The Piotroski-Graham model remains one of the best value investment strategies, rigorously tested and documented to generate significant value returns annually.

- Value stocks, often neglected and underfollowed, present high investment potential, especially as market conditions shift favorably towards value from growth.

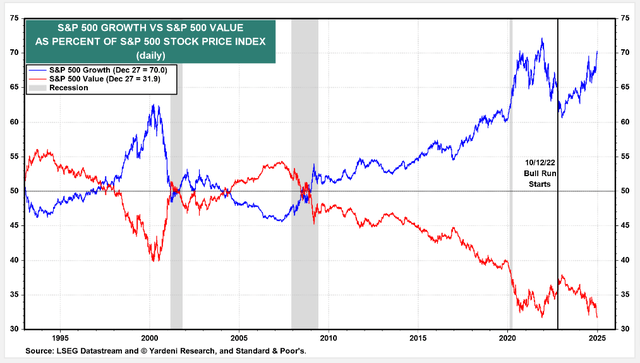

- The record skew to Growth stocks at the most extreme levels since 1998 may begin to unwind in 2025 in a very favorable direction for the strongest Value stocks.

Introduction

These selections continue as ongoing tests of a combination of the two most successful value algorithms published in peer-reviewed financial literature with additional customized enhancements.

Top Piotroski-Graham Long Term Value Portfolio: New 2025 Selections

These top 10 selections for the January 2025 long-term portfolio comprise the 27th portfolio since 2017 formed to test the long-term value approach of the Joseph Piotroski and Benjamin Graham’s value algorithms that remain two of the best-performing value-based selection models in peer-reviewed financial research. The portfolios are now released 2 times per year and measured for 2-years following the original measurement periods set by Piotroski and Graham.

There are also important macro factors that investors should consider when choosing Value portfolios over Growth portfolios. Even the best models in the financial literature can underperform when market conditions are at extremes as they are now. Value stocks are greatly underperforming the Growth stocks as a % of the S&P 500 index and could come back into favor as investors move out of the most crowded growth trades.

S&P 500 Growth vs. Value – 1994 to 2024