Summary

- Excessive debt accumulation poses systemic risks; market rotation requires active trading beyond buy-and-hold strategies.

- Momentum Gauges indicate high negative values, suggesting a bearish outlook and potential for significant market volatility.

- The Magnificent 7 stocks are underperforming, highlighting the importance of timing and market rotation awareness.

- Watch for shifts to value stocks, bonds, gold, and bitcoin as key signals in navigating upcoming market changes.

- The S&P 500 still has not had a single day of +/- 2% volatility and this is significantly below annual averages.

Introduction

“If there is one common theme to the vast range of the world’s financial crises, it is that excessive debt accumulation, whether by the government, banks, corporations, or consumers, often poses greater systemic risks than it seems during a boom.” — Carmen Reinhart

I have spent the last 35 years trading, researching, and constructing algorithms to identify and leverage the value across fundamental, technical, and behavioral finance models. Of the ten portfolio models designed for optimal portfolio mixes for members to beat the market at Value & Momentum Breakouts, eight come from enhancing well-tested anomaly research in published financial journals.

If you believe like I do, that there is much more to stock trading than just buy, hold, and hope that every future event works out perfectly as promised for your stock – then these trading models are for you. This article highlights some of our recent top trades from three very different portfolio models, ranging from aggressive short-term weekly breakouts to long-term growth and value portfolios with high dividends.

As I detailed in my 2025 Market Forecast article, I am certain again this year that we will see more rotation and if you are just riding the buy and hold approach you can find yourself in a painful situation.

Highlighting the Value of Momentum Gauges

Unlike prior weekly articles, this week I share a unique progression to the next stage of the market rotation we have been cautioning about for more than a year:

- Market Resilience Amidst The Brutal Rotations To The Next Rally

- Record Market Skew Leads To Broadest Stock Breakout Since November

- Technology Hitting The Peak Of The 2024 Market Cycle With Rotation To Value

Quick revisit to my prior podcast more than a year ago warning that the “unstoppable Magnificent 7” are not impervious to pullbacks and that timing matters greatly:

The thing to consider is that we rarely ever see market leaders from the prior year be market leaders for the coming year. ~ JD Henning, January Podcast 2024

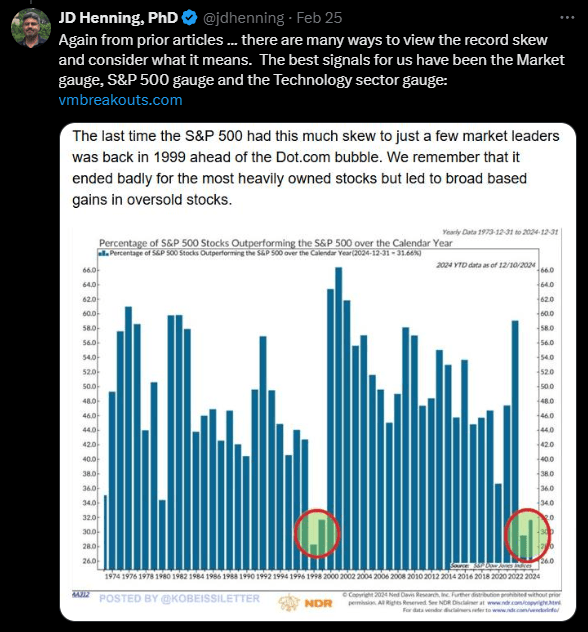

If you have been following my articles and posts then you know that I have been cautioning thousands of readers and subscribers about the record market skew.

The last time the S&P 500 had this much skew to just a few market leaders was back in 1999 ahead of the Dot com bubble.”