Summary

- FOMO-driven trading increases volatility and erodes wealth; disciplined timing and model-based strategies are essential for sustainable outperformance.

- My portfolio models leverage fundamental, technical, and behavioral signals to identify stocks poised for both short-term breakouts and long-term growth.

- Recent picks demonstrate the power of rotation-aware, signal-driven investing versus passive buy-and-hold approaches.

- Following Momentum Gauge signals and sector rotations can help investors avoid downturns and capture gains, especially in volatile markets.

- Record volatility is generating extreme moves with more +/- 2% daily moves in the S&P 500 for April than all of 2024 combined. Timing is critical in such record high volatility.

Introduction

The long-term implications of FOMO-driven behavior in the stock market raise concerns about the sustainability of such practices. While FOMO can generate short-term gains for some investors, the overall impact on financial stability and market efficiency is often negative. Over time, the frequent buying and selling of stocks based on emotional reactions to market trends can erode investor wealth, particularly when transaction costs and poor timing are taken into account. Moreover, FOMO-driven behavior contributes to increased market volatility, as large numbers of investors simultaneously rush into or exit the market based on fear and speculation (Hoffman et al., 2020).

I have spent the last 35 years trading, researching, and constructing algorithms to identify and leverage the value across fundamental, technical, and behavioral finance models. Of the ten portfolio models designed for optimal portfolio mixes for members to beat the market at Value & Momentum Breakouts, eight come from enhancing well-tested anomaly research in published financial journals.

If you believe like I do, that there is much more to stock trading than just buy, hold, and hope that every future event works out perfectly as promised for your stock – then these trading models are for you. This article highlights the importance of timing and reveals stocks from our top portfolios that may weather the record rotation currently underway.

As I detailed in my 2025 Market Forecast article and recent updates, I am certain again this year that we will see more rotation. And if you are just riding the buy and hold approach, you can find yourself in a painful situation.

Three Trades from Different Portfolio Models

In this article, I provide a sampling of how we use the optimal portfolio models to identify long term continued strength, short term aggressive breakout stocks, and even apply timing models to long-term value stocks for the best results. As I repeatedly tell our investment community, it is important to not only diversify your stock selections, but it is also critical to be where the market fund flows are improving for the best returns. As many long-term traders know well, it is very rare for one type of investment to lead in consecutive years. More details explain our process in my 2025 Market Forecast article. I am certain again this year that we will see more rotation and if you are just riding the buy and hold approach, you can find yourself in a painful situation.

Current Markets

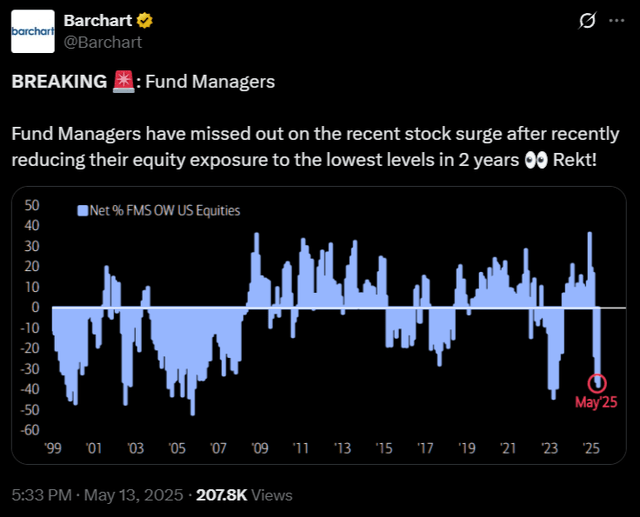

As I have posted and written about frequently, 2025 was the worst start for the markets since at least 2022 with large declines and strong rotations out of Mega Caps. April has already had more +/- 2% daily S&P 500 moves than all of 2024 combined and the Volatility is on pace to meet or exceed 2022 levels. This week we learn that Hedge Funds have been the most defensive in 2 years and missing out on one of the fastest and largest rebounds in years.

First, let me briefly introduce a sample of stocks and ETFs from our portfolios that I will review in this article. These investments each come from different models that I share for members at regular weekly, monthly, annual intervals depending on the portfolio type. Then I will explain why each security was selected for its respective portfolio. Last, I will share why the timing matters even in our value investing portfolios for long-term growth…